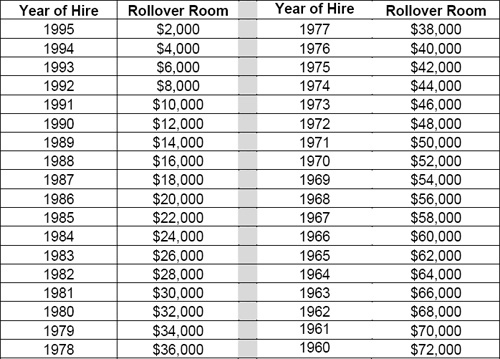

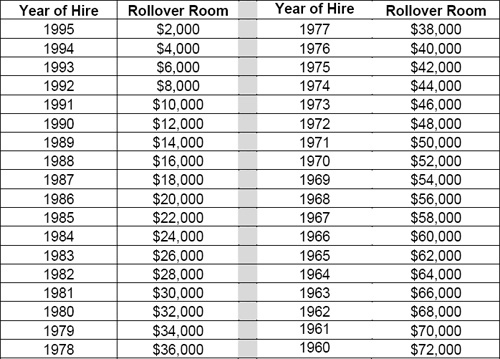

Severance payments for loss of employment qualify as a retiring allowance. Retiring allowances qualify for tax-free transfer by West Fraser directly to our employees RRSP - the money cannot be paid to the employee first. This new room is outside of any personal RRSP room that the individual has. This tax-free transfer is available to employees with service BEFORE 1996 with West Fraser. The eligible amount is $2,000 per full or part year of service before 1996. These transfers must be made into the employee's RRSP (not a spousal RRSP). These are regular RRSP's, not locked in accounts which are typically reserved for pension plan money.

The service must not have breaks where the employee quit and returned to West Fraser. For example, Bob worked for West Fraser from 1972 to 1980. He left the company and returned in 1983 until present. Bob would have $26,000 of RRSP rollover room based on his current 1983 hire date. His service from 1972 through 1980 would not be eligible.

To find out how much personal RRSP room (which is different from the rollover room described above) please see your 2008 Notice of Assessment which you would have received from CRA after filing your 2008 income taxes. This will tell you how much personal RRSP room you have. Remember to deduct any RRSP contributions you have made after March 1, 2009 off that amount.